Let's see how to get box 505 of the Income and thus obtain the reference number for natural persons. And the reference number is an authentication and identification system that allows taxpayers to consult tax data and thus present the Statement of income during the corresponding campaign, which is usually from beginning of April to end of June every year. Therefore, we tell you how to obtain box 505 of the Income step by step so you don't have any problems with your statement.

Income Box 505: how to obtain the reference number

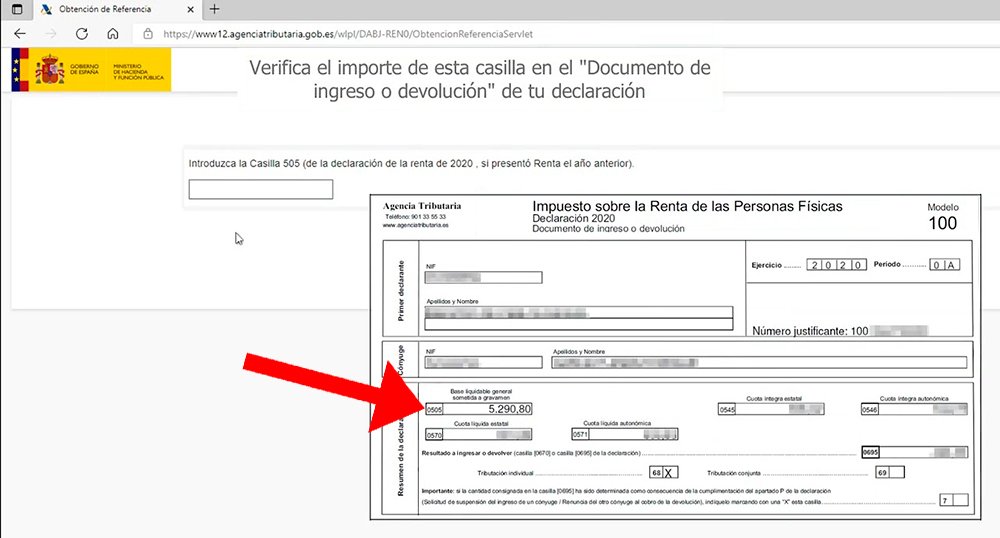

To obtain this number it is necessary enter the amount of the general taxable base subject to tax separating the decimals with a comma. In the event of not having submitted the Income Tax the immediately previous year or if the result in box 505 was equal to zero, the interested natural person will have to have the Iban number of a bank account as its owner.

How to find box 505

If the Income Tax was submitted the previous year and you want to obtain the reference number with box 505, it will be necessary access the Income portal for that year. For identification, the taxpayer must enter their ID either NIE to show the DNI validity date, also necessary for identification. In the case of a DNI without a validity date (type K, L or M), the information to be provided will be the birth date of the same document.

After entering this information it will be necessary to click on Continue so that the application offers different alternatives depending on the DNI or NIE provided, in order to recognize whether said user is registered or not in the Cl@ve system to use said alternative identification system. In that case, click on Get Reference with box 505. If the taxpayer is disqualified from performing this action, this option may not appear.

Once identified, the taxpayer must enter the amount of the general taxable base subject to tax corresponding to the Income of the previous year or the last five positions of the IBAN if the declaration was not filed the previous year. Afterwards you will only need to click on Get reference to se her six-digit reference to manage the income.

We recommend write down the reference number for later use, although it is possible to obtain up to 10 references per day. Now you know how to obtain box 505 for your Income Tax Return.