Let's see how to know the status of the statement of income, so that you can learn to check how your procedure is going with Tax authorities and what kind of states you can find yourself. And after submitting the Income Tax return, people usually forget about it. Unless it pays you, at which point you deposit the corresponding money and until next year. But if the result is in your favor, then things change. And although returns are usually made quickly, sometimes the return can take several months. Therefore, it is advisable to know how to consult the state of the income tax return; Below we tell you how to do it and the types of states you can find.

How to know the status of the income tax return

Index of contents

-

Check the status during the Income campaign period

-

Check the status outside of the Income campaign

-

Check the income status by phone

-

What are the statuses of the Income Tax return?

-

How long does it take for the Treasury to make the refund?

Check the status during the Income campaign period

If you want to check the status of your Income Tax return in campaign period through a Web navigator follow the following steps:

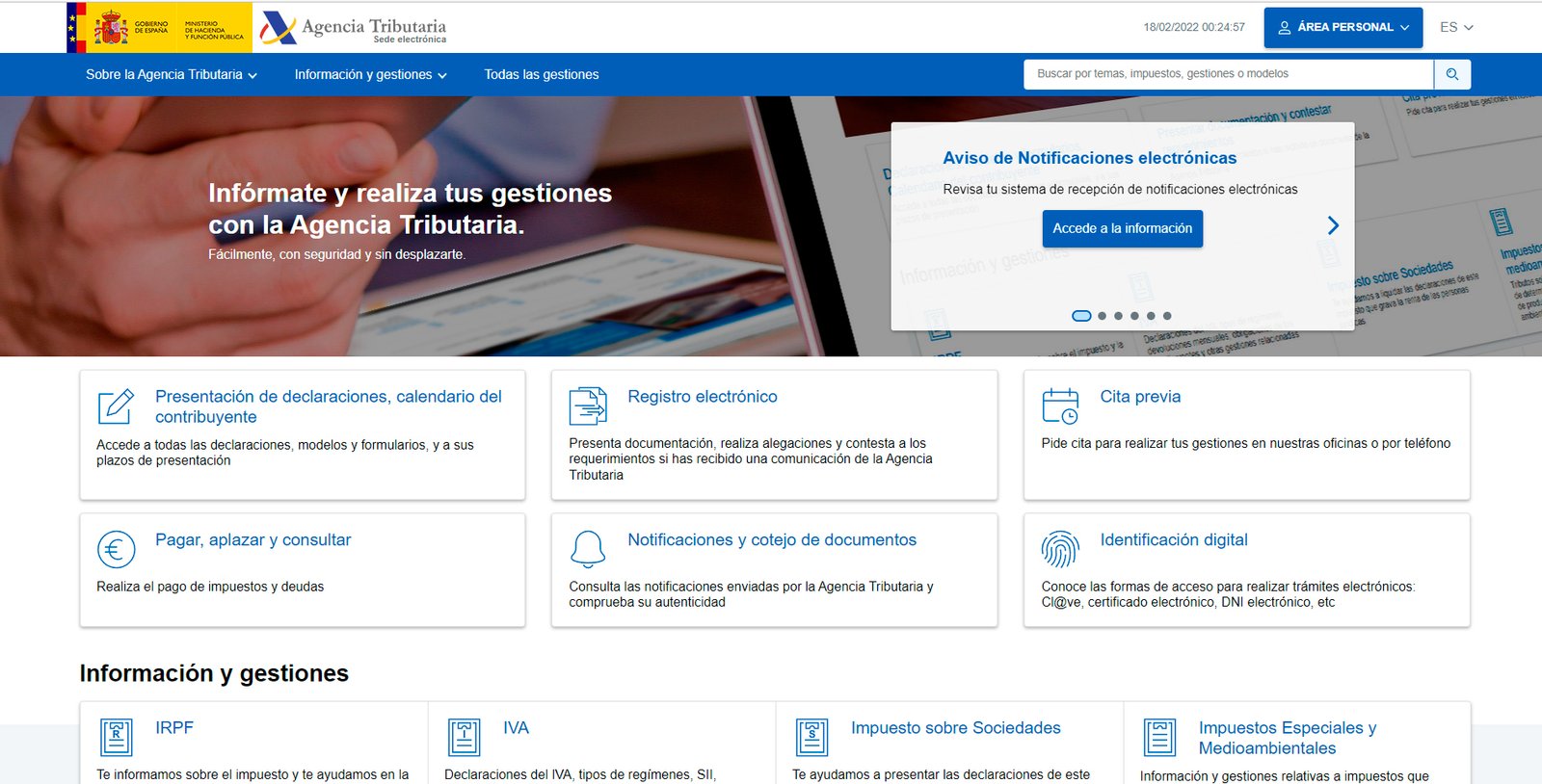

- Access the Web page of the Tax Agency.

- Click Rent XXXX (XXXX corresponds to the year of the fiscal year) at the top of the screen.

- Now click on the option Draft/declaration processing service (WEB Income).

- Identify yourself with certificate either electronic ID, with Cl@ve PIN or with him reference number 6 digits of your declaration.

- Once identified, select the option Declaration status, where you can see the current status of your Income Tax return.

You can do this same process through your mobile with the app Rent XXXX (XXXX corresponds to the year of the fiscal year), available free of charge at iOS (iPhone) and Android in the declaration period of the Rent. After downloading the app and identifying yourself, you will only have to follow the steps from the previous section.

Check the status outside of the Income campaign

It is also possible to check the status of your Income Tax return off campaign through the following steps:

- Access the Web page of the Tax Agency.

- Now click on the option Taxes and rates on the left side of the screen.

- Select the option Personal Income Tax.

- A list will appear with different taxes; select in Income Tax either Statement of income.

- Now select Model 100.

- Finally access Processing Service.

This option will be available in the first section of Formalities, within the options of Rental Services. If you haven't done so yet, you will now need to log in.

Check the income status by phone

If you do not want to make the consultation online you can always call directly. To do this, you must make a call to the number 901 12 12 24 and facilitate the NIF either NIE and the amount of refund requested.

What are the statuses of the Income Tax return?

Depending on the status of the processing of your Income Tax return file, you may encounter one of the following messages corresponding to a state specific:

- Your declaration is being processed: The AEAT already has your declaration and is waiting to validate the data.

- Your statement has been recorded and verification is being carried out: The AEAT is already processing your declaration and checking that everything is correct.

- Your declaration has been processed by the Tax Management bodies, estimating the refund requested by you in accordance with: The processing has been completed successfully but you still need to be informed about when the refund will be effective.

- Your return has been issued on XX/XX/XXXX; If you have not received the amount within 10 days, go to the Tax Agency delegation/administration corresponding to your tax domicile.: The AEAT has made the payment that must arrive within a period of no more than 10 days.

- The declaration with the indicated amount has not been recorded or is in process. Check the amount: An error message indicating that the declaration has not been processed correctly. Although it is possible that you can resubmit it electronically, the most normal thing is that you go to the Treasury to resolve the incident.

How long does it take for the Treasury to make the refund?

The period established to make the refund of the amount of the Income Tax return is six months, a period that will begin to count from the end of the personal income tax campaign. Thus, the maximum period for the return is established in the December 30 of the same year of the Income Tax return.

Of course, in some cases it is possible that the return delayed until next year, adding to the amount a late payment interest from the AEAT, that is, financial compensation for the citizen for the delay in payment. Said late payment interest is set at a 3,75% annually and will be applied proportionally to the days of delay.